Death and taxes are inevitable. But in the world of crypto, taxes don’t just happen once a year—every single trade, swap, or staking reward is a taxable event.

If you made 500 trades this year across Binance, MetaMask, and Solana, calculating your capital gains manually on a spreadsheet isn’t just difficult; it is impossible. One mistake could trigger an audit from the IRS (USA) or HMRC (UK).

At CryptoScopeLab, we tested the leading tax platforms to see which ones accurately handle DeFi protocols, NFTs, and cross-chain bridges. Here is our list of the top 5 tools that will save you hours of headaches and potentially thousands of dollars.

Why You Need Specialized Software?

Many investors ask: “Can’t I just give my CSV files to my accountant?”

Most traditional accountants do not understand how to calculate the cost basis of an LP token on Uniswap or an NFT mint on Ethereum. Crypto tax software automates this by connecting to your wallets via API (Read-Only), categorizing transactions, and generating a compliant tax report (Form 8949) in minutes.

1. Koinly: The Best Overall Solution

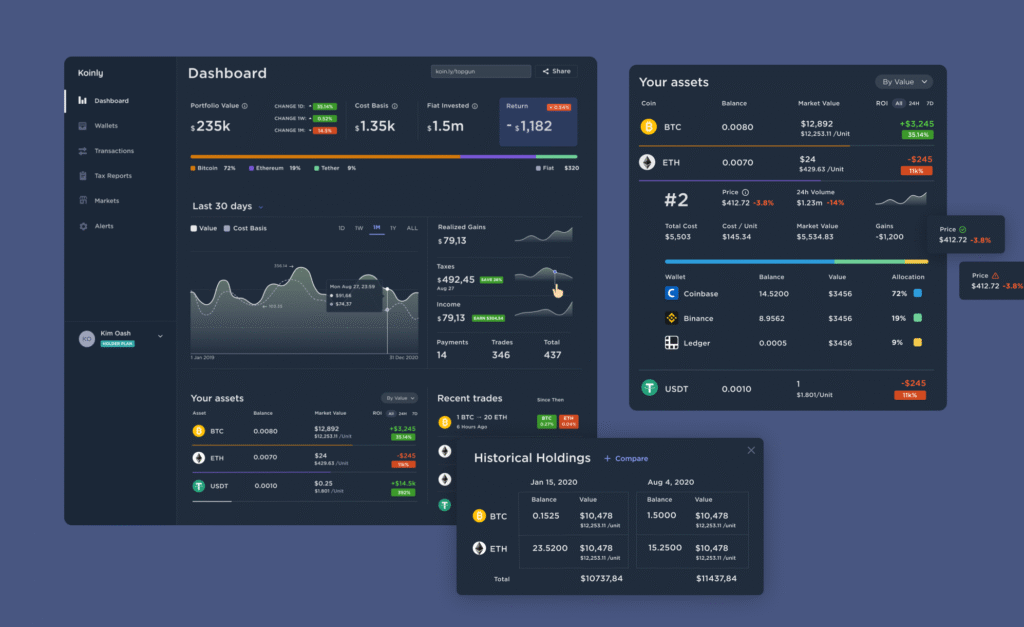

Koinly is widely considered the gold standard for international crypto investors. It supports over 20 countries and integrates with 700+ wallets and exchanges.

The Lab Analysis

- Ease of Use: 10/10. The interface is clean and intuitive.

- DeFi Support: Koinly is exceptionally good at detecting smart contract interactions automatically.

- Pricing: Free to track your portfolio. You only pay (~$49+) when you want to download the tax report.

Lab Verdict: Perfect for the average investor and the heavy trader alike.

2. CoinLedger (Formerly CryptoTrader.Tax): Best for US Investors

If you are based in the United States and use TurboTax to file your general taxes, CoinLedger is your best friend.

The Lab Analysis

- Integration: It is an official partner of TurboTax, meaning you can import your crypto data directly into your tax return.

- NFT Support: They recently upgraded their engine to handle NFT royalties and minting costs seamlessly.

Lab Verdict: The “TurboTax” of the crypto world. Simple, fast, and compliant.

3. TokenTax: For the DeFi Whales

TokenTax is not just software; it is a full-service crypto accounting firm. They handle the most complex scenarios that other software might miss.

The Lab Analysis

- The Power: It can handle margin trading, futures, and complex DeFi lending protocols better than anyone.

- The Downside: It is significantly more expensive than competitors.

Lab Verdict: Choose this if you have a high net worth portfolio with complex on-chain activity.

4. ZenLedger: Great for DeFi Degens

ZenLedger focuses heavily on the decentralized finance sector. If you spend most of your time on DEXs (Decentralized Exchanges) like PancakeSwap or Aave, this tool shines.

The Lab Analysis

- Grand Unified Accounting: It has a unique feature to aggregate all your wallets into a single dashboard to see your true net worth.

5. Accointing: Best for Portfolio Tracking

While it is a powerful tax tool, Accointing is famous for its mobile app that acts as a portfolio tracker first.

The Lab Analysis

- Visuals: It offers the best charts and graphs to visualize your portfolio allocation.

- Tax Optimization: It has a dedicated “Holding Period” tool to show which coins are about to become long-term capital gains (taxed at a lower rate).

Pro Tip: How to “Make Money” with Tax Software

The real value of these tools isn’t just compliance; it is Tax Loss Harvesting.

This strategy involves selling assets that are currently at a loss to offset your capital gains.

- Example: You made $10,000 profit on Bitcoin. You also hold an altcoin that is down $4,000.

- The Move: You sell the altcoin to realize the $4,000 loss. Now, you only pay taxes on $6,000 of profit instead of $10,000.

Tools like Koinly and CoinLedger have dashboards that show you exactly which coins to sell to lower your tax bill before the year ends.

Conclusion

Don’t wait until April 14th to start worrying about your crypto taxes. By then, it will be too late to use strategies like Tax Loss Harvesting.

For most users, Koinly offers the best balance of price and features. For US citizens who want simplicity, CoinLedger is the top pick.

Secure your financial future by being compliant. The blockchain is transparent, and tax agencies are watching.

Disclaimer: CryptoScopeLab is an educational platform. We are not certified financial advisors or tax professionals. Tax laws vary by country and change frequently. Always consult with a qualified CPA for your specific situation.