The decentralized finance (DeFi) space is often called the “Wild West.” The potential for 100x gains is real, but so is the danger. For every hidden gem like Solana or Kaspa in their early days, there are hundreds of scams designed to drain your wallet.

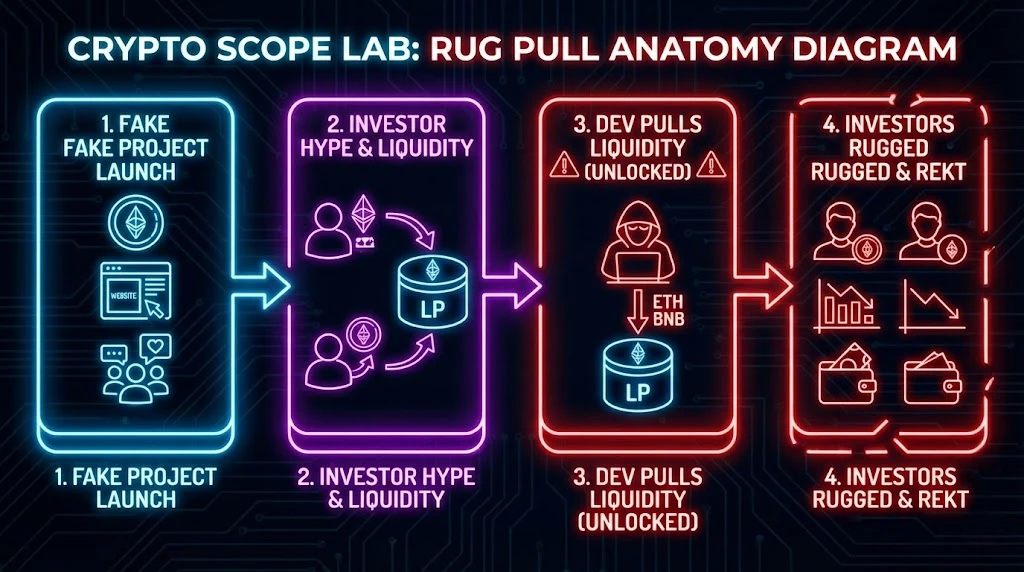

The most common of these is the “Rug Pull.” This happens when developers abandon a project and run away with investors’ funds, leaving you with worthless tokens.

At CryptoScopeLab, we believe that data doesn’t lie. You don’t need to be a code expert to stay safe; you just need to know where to look. We have compiled the 7 critical “Red Flags” that our analysts check before investing a single cent.

1. Unlocked Liquidity (The #1 Danger Sign)

Liquidity is the pool of money (usually ETH or BNB) that allows users to buy and sell a token.

If the developers hold the “Liquidity Provider (LP) Tokens” in their own wallet and they are not locked, they can withdraw the entire liquidity pool at any second. If they pull the liquidity, you cannot sell your tokens. The price effectively goes to zero instantly.

The Lab Check:

- Always look for a Liquidity Lock Certificate. Reputable projects lock their liquidity for at least 6 months to 1 year on platforms like Unicrypt, PinkSale, or Team.Finance.

- If you cannot find a lock link, consider the project unsafe.

2. The “Honeypot” Trap

A Honeypot is a smart contract that allows you to buy the token, but prevents you from selling it. You watch the chart go up and up, thinking you are rich, but when you try to swap it back to ETH or USDT, the transaction fails.

The Lab Check:

- Never buy a new token without simulating a sell transaction first.

- Use free tools like Token Sniffer or Honeypot.is. Paste the contract address. If the result says “Selling is disabled,” run away.

3. Uneven Token Distribution (Whale Alert)

Before buying, check the “Holders” tab on a block explorer like Etherscan or BscScan.

In a fair project, the tokens should be widely distributed. If you see that a single wallet (that is not an exchange or a burn address) holds 20% or more of the total supply, you are in danger. That one person can dump their entire bag on the market, crashing the price by 90% in a single candle.

4. The “Mint” Function

Malicious developers sometimes hide a function in the smart contract code that allows them to “mint” (create) unlimited new tokens.

Imagine investing in a coin with a supply of 1 million. Suddenly, the developer prints 100 million new tokens and sells them all into the market. The value of your tokens becomes microscopic.

The Lab Check:

- Check the contract audit for “Mint Function” capabilities. If the owner has minting rights, the project is centralized and high-risk.

5. Fake or Generic Audits

“Audited” is a buzzword scammers love to use. They often pay for cheap, automated audits or simply put a “100% Secure” badge on their website without any proof.

The Lab Check:

- A real audit comes from a reputable firm like CertiK, Hacken, or SlowMist.

- Go to the auditor’s official website and search for the project name. If the report isn’t there, the audit is fake.

6. Anonymous Team with No Track Record

While anonymity is part of crypto culture (Satoshi Nakamoto was anonymous), it is also a shield for scammers.

If a project claims to be building “The Future of AI” but the team members have:

- No LinkedIn profiles.

- Twitter accounts created last month.

- Profile pictures stolen from stock photo sites (Reverse Image Search is your friend).

…then the likelihood of a Rug Pull is extremely high.

7. Artificial Social Hype (Bot Activity)

Be skeptical of Telegram groups with 50,000 members but only 5 people talking. Scammers buy fake members and bots to create a “Fear Of Missing Out” (FOMO) atmosphere.

If the chat is full of GIFs and messages like “To the moon!” or “Buy now!” but has zero discussion about the technology or roadmap, it is likely a manufactured hype bubble.

The CryptoScopeLab Toolkit: Essential Safety Links

Don’t trust words; trust code. Bookmark these free tools to analyze any project before you invest:

- Token Sniffer: Automated smart contract audit.

- Bubble Maps: Visualizes wallet connections (great for spotting wash trading).

- DEXTools / DEXScreener: Shows real-time charts and liquidity lock status.

- Revoke.cash: Use this to disconnect your wallet from suspicious sites.

Final Verdict

The best defense against a Rug Pull is patience. Scammers rely on your greed and your rush to “get in early.”

At CryptoScopeLab, our rule is simple: If the liquidity is unlocked or the code is verified as a honeypot, we stay on the sidelines. No matter how good the website looks, the safety of your capital is the priority.

To secure your long-term holdings, always move your assets off exchanges and into a cold wallet. Read our [Ledger vs. Trezor Comparison] to find the best security solution for you.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. Always do your own research.